Make the right turn

Compare

Switch Save

Would you like to compare your quotes?

More ways to compare and save

Compare Switch Save

Low cost insurance quotes in less than 5 minutes

Enter your details

Get quotes online

Switch

Save

WHAT WOULD YOU LIKE TO COMPARE?

Get what you need at the price it needs to be

The best car insurance for you is an affordable policy that covers what you need – don’t just pick the cheapest option.

You’ll need third party cover as a minimum. It’s compulsory, and you can’t legally drive without it. But exactly what you’re covered for depends on the type of policy you choose.

Van Insurance

Getting quotes from lots of different van insurance providers can really help to cut the cost.

When you compare van insurance with us, we’ll show you the price, but also some of the policy features that are included or excluded.

That’ll help you choose the right cover for your van. We know how important that is – your van is more than just a vehicle to you, especially if your business depends on it.

Getting quotes from lots of different van insurance providers can really help to cut the cost.

That’ll help you choose the right cover for your van. We know how important that is – your van is more than just a vehicle to you, especially if your business depends on it.

Motorbike insurance is designed to help protect riders against costs in the event of an accident or incident, like vandalism or the. All motorbike riders in the UK are required to have insurance by law.

Home Insurance

Home insurance covers loss and damage to your house and household contents. For example, if your home is damaged by an insured event like a fire or flood, your home insurance may cover the cost of any repairs or replacements needed. Home insurance comes in two parts – buildings insurance which covers the physical building, and contents insurance which covers your belongings. You can buy them individually or together as a combined policy.

Home insurance covers loss and damage to your house and household contents. For example, if your home is damaged by an insured event like a fire or flood, your home insurance may cover the cost of any repairs or replacements needed. Home insurance comes in two parts – buildings insurance which covers the physical building, and contents insurance which covers your belongings. You can buy them individually or together as a combined policy.

There are four main types of pet insurance, so it can be hard to decide on the right one for you and your pet.

Think about what you want from your pet insurance. Accident only or time-limited cover is better for expensive, short-term incidents and illnesses. Lifetime and maximum benefit can help cover the cost of treatment for single conditions that go on for many years.

Travel Insurance

Travel insurance can cover unexpected costs while you’re on holiday. Things like replacing lost luggage, reimbursing your travel costs due to trip cancellation, and paying for emergency overseas medical expenses.

If you didn’t have travel insurance, you’d have to pay for this yourself or be left out of pocket. Which could work out pretty pricey.

This makes travel insurance as essential as your passport. Don’t leave it off your holiday checklist.

Travel insurance can cover unexpected costs while you’re on holiday. Things like replacing lost luggage, reimbursing your travel costs due to trip cancellation, and paying for emergency overseas medical expenses.

If you didn’t have travel insurance, you’d have to pay for this yourself or be left out of pocket. Which could work out pretty pricey.

This makes travel insurance as essential as your passport. Don’t leave it off your holiday checklist.

Your actual bicycle insurance quote will be calculated based on your circumstances and takes into consideration what kind of bike you ride and its value.

Mountain bikes, pushbikes, road bikes, folding bikes, hybrids and electric bikes are all usually covered. If you’re riding a self-built custom bicycle, you can get insurance for your bike’s unique specification.

If you need to make a claim, it’ll reflect the true value of the bike. Just make sure your insurer’s aware of any modifications before you buy a policy, otherwise you might not be covered.

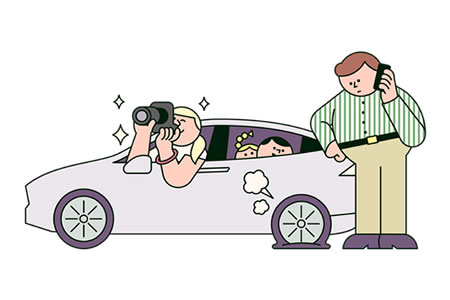

Breakdown Cover

Breakdown cover helps you get back on the road if you can’t get your vehicle up and running.

You can purchase it for cars, motorbikes or vans, and it’s typically not included in your insurance policy.

Assistance will be sent if your vehicle breaks down and you’re unable to continue on with your journey. It will either be fixed by the side of the road or towed to a garage for repairs.

Some policies will even visit you at home to get your vehicle started.

Breakdown cover helps you get back on the road if you can’t get your vehicle up and running.

You can purchase it for cars, motorbikes or vans, and it’s typically not included in your insurance policy.

Assistance will be sent if your vehicle breaks down and you’re unable to continue on with your journey. It will either be fixed by the side of the road or towed to a garage for repairs.

Some policies will even visit you at home to get your vehicle started.

iCompare4U Product Benefits!

QUICK & EASY

Compare quotes quickly and easily.

5 minutes is all it takes!

COMPETITIVE RATES

You are in the right place to find competitive

rates online

GREAT DEALS

Looking for a great deal? Compare 110+ trusted insurance companies.

Compare 110+ trusted insurance companies

You want a supplier to cover all your needs. Comparing quotes can help you find the best fit.